Payment Options

Payment arrangements are required to be completed prior to the start of each academic term. Families can either pay the full balance or enroll in the Installment Payment Plan, which requires a minimum 20 percent payment of the semester balance. The deadline for either option is August 5, 2024 for the Fall semester and January 3, 2025 for the Spring semester.

Due to the shorter period, the Summer term is compressed to three installments for the payment plan. The first payment of at least one-third of the balance is due May 1, 2025.

For Distance Learning programs, please visit myonline.bradley.edu

Pay In Full Option

The most economical option, the Pay In Full plan requires the entire semester balance charges, less financial assistance to be paid in full on or before the due date for that semester: August 5, 2024 for the fall semester and January 3, 2025 for the spring semester. If the balance for the semester is paid in full prior to the first day of the term, no additional fees are charged unless changes are made to the student's schedule or financial aid.

Installment Payment Plan

This plan divides each semesters' balance into five installments. Payment is determined by taking semester charges, subtracting semester financial assistance (not including work study), and dividing the balance by 5 and adding a one-time $30 enrollment fee. The first payment must be a minimum of 20% of the semester balance and is required by either the Aug. 5, 2024 or Jan. 3, 2025 deadline for the respective term. A one-time finance charge of 4% will be applied to the remaining balance on the first day of the term. Remaining fall payments are due on the 15th of the month in September, October, November, and December; spring payments in February, March, April, and May. You must enroll in the installment payment plan each semester. Once enrolled in the Installment Payment Plan all payments must be made online. Enrollment instructions can be found here.

Summer 2024 Payment Due Dates

- May 1, 2024

- June 1, 2024

- July 1, 2024

Fall 2024 Payment Due Dates

- August 5, 2024

- September 15, 2024

- October 15, 2024

- November 15, 2024

- December 15, 2024

Spring 2025 Payment Due Dates

- January 3, 2025

- February 15, 2025

- March 15, 2025

- April 15, 2025

- May 15, 2025

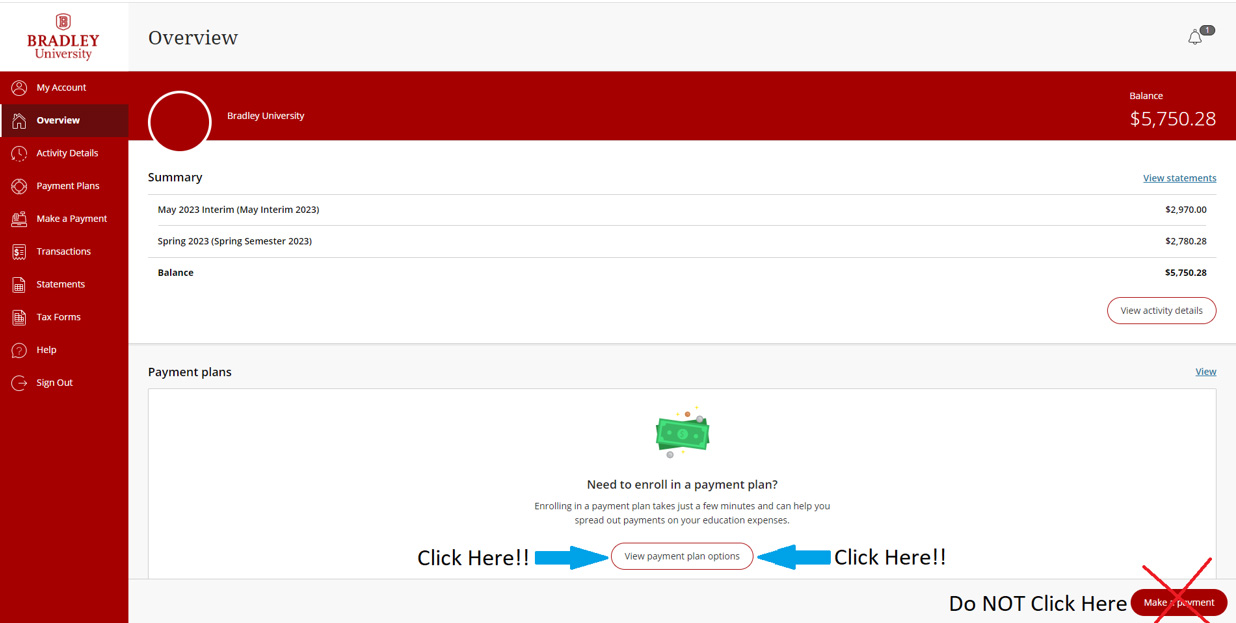

Transact - Payment Plan Enrollment

Step 1

Once you are logged in, then click on the View Payment Plan Options button located near the bottom of the Overview page. Do not click on the Make Payment button.

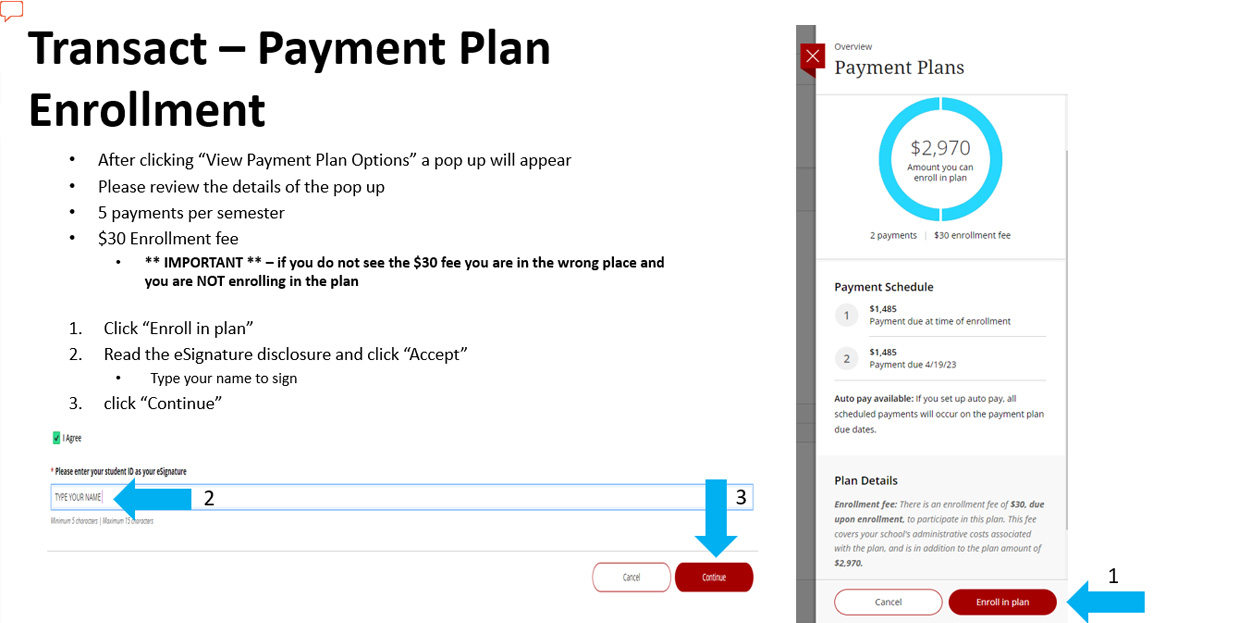

Step 2

- After clicking “View Payment Plan Options” a pop up will appear

- Please review the details of the pop up

- During the Fall and spring semesters the payment plan will offer five monthly installments per term with a $30 enrollment fee per semester.

** IMPORTANT ** – if you do not see the $30 fee you are in the wrong place and you are NOT enrolling in the plan - Click “Enroll in plan” located at the bottom of the pop up page

- Read the eSignature disclosure and click “Accept”

- Type your name to sign

- click “Continue”

Step 3

Verify the information on the page and click continue.

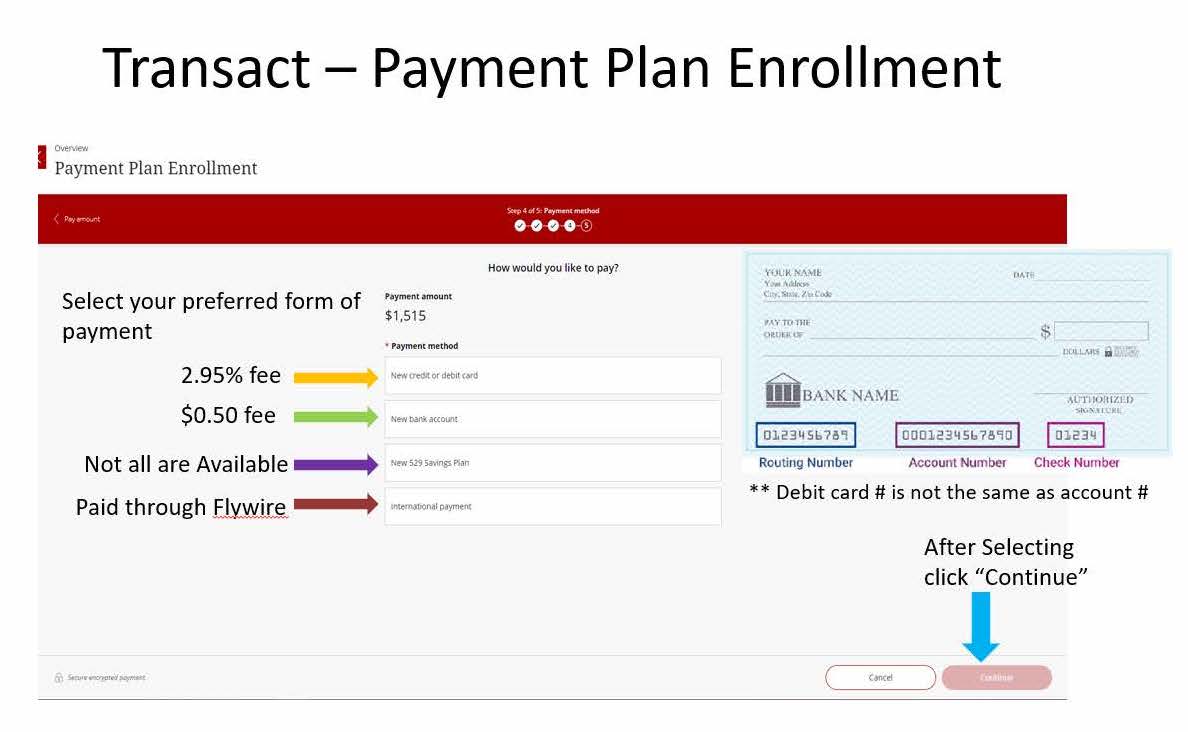

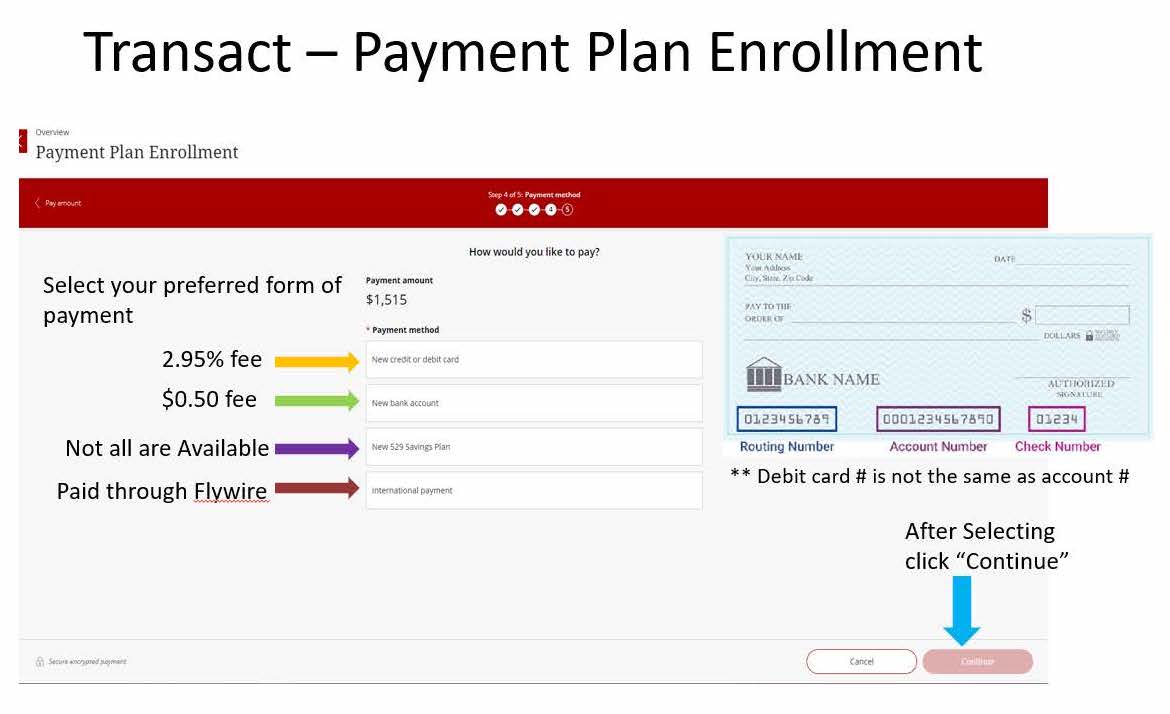

Step 4

Select your preferred form of payment and then click continue.